Not Winning, But Printing Lots of Dollars (Finance Friday)

Washington is partying like it’s 1999, except on China

Welcome to Super Macro’s first edition of Finance Friday, where politics and business collide to make ugly children.

Tech companies reported this week the biggest earnings ever and the fastest growth, which was met with a sigh from the market. Is this the top of a rally that is grossly overextended by any historical metric? The price-to-earnings ratio of the S&P 500 stands around 35 and price-to-sales is 3.2—both higher than during the dotcom bubble and about twice where they ought to be.

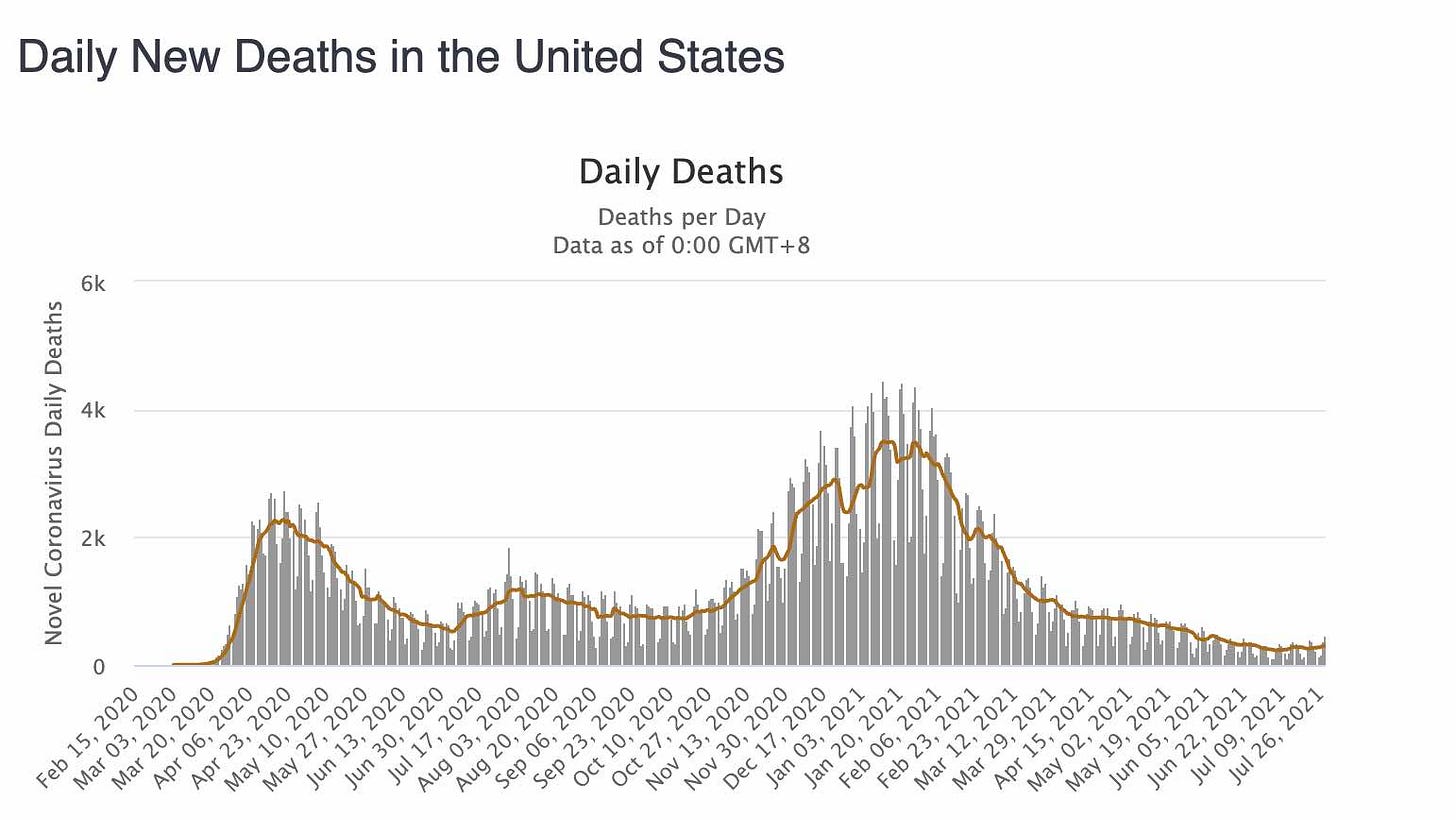

What could pop the bubble? The WuFlu Delta variant hasn’t led to a significant increase in deaths in the USA, but it has given cheer to health bureaucrats and shutdownistas. Will mask mandates returning to blue cities spook investors?

As with the Delta increase in Britain, the U.S. increase has not significantly changed the death rate. Source: Worldometer.

For its part, the Fed chose again to pretend inflation is not a problem. To paraphrase its policy statement this week: things are good, but the highest GDP growth and inflation since Trading Places was released in 1983 have somehow not convinced us to raise rates or curb open-market operations (creating dollars out of thin air to buy government and corporate debt).

Just a wee bit of peso printing.

The Fed’s story that it will begin raising rates in 2023 won’t work out. Democrats will never tolerate a Fed raising rates going into a tough presidential election cycle with an economy that is already certain to be much slower than today’s. The reality is that the Fed is only “independent” during Republican administrations and the Fed chairman acts more like an assistant secretary at the Treasury Department when Dems are in the White House. That’s why the Fed kept rates near zero during all of Obama and raised them aggressively during Trump. What this reality and political timing suggest is that inflation will get much farther out of hand than the market currently predicts.

The Fed helped Obama, not Trump. Source: Washington Post

But of course there is no inflation, except that which is “transitory.” Meanwhile Murban crude is $75 and climbing, gas costs nearly four bucks a gallon, and food prices are climbing rapidly as well. Biden is suddenly under water in voter approval in some polls and heading south.

The Joy of Export Controls

Giving credit where credit where credit is due, the Biden administration has kept up tariffs and export controls on China. It is basically the only area of foreign or domestic policy that the White House has not sought to reverse from the Trump administration or at least signal considerable distance.

This continuation was reinforced by the White House’s decision to nominate Alan Estevez to be under secretary overseeing the Commerce Department’s Bureau of Industry and Security. The previously obscure bureau manages export controls and achieved prominence in the Trump administration when it began restricting U.S.-made technology from benefiting Huawei and other Chinese semiconductor companies—even if the technology is located overseas in places like Taiwan, Japan, and South Korea.

Estevez’s appointment came six months into the administration—unusual at the top tier of the Commerce Department, which is often an easy department to populate with political appointees (it was called “Bush Gardens” during Bush 43 given the number of politicals parked there). The delay reflected indecision at the White House and by Commerce Secretary Gina Raimondo over export controls and China policy. Previously the governor of Rhode Island, Raimondo had limited experience with the topic. The administration passed over early favorite Kevin Wolf, who ran the bureau in the Obama administration, because he was seen as dovish on China and a critic of Trump-era restrictions. In contrast, Estevez is a long-serving Pentagon bureaucrat who managed the Defense Department’s seat on CFIUS (pronounced SIFF-ee-yus, it sounds like something one might catch at Mardi Gras, but is in fact the foreign-merger-killing Committee on Foreign Investment in the United States).

In a recent discussion I moderated featuring former deputy U.S. Trade Representative C.J. Mahoney, he noted that trade moves in the previous administration were not intended to “delink” the USA from China, but were intended to signal U.S. businesses to begin to diversify their supply chains out of China. Biden seems tacitly to be continuing this policy, but it is unclear if it will persist.

Still looming in the administration is climate czar John Kerry (also special envoy for marrying rich women). Memorably dubbed “hideous lantern jaw” by the North Koreans, Kerry wants a climate deal with China that exceeds the easily ignored requirements of the Paris climate deal. At some point, he will press his former Senate buddy Joe Biden to concede something big to Beijing for a deal. Lantern jaw visited China in April and has been talking up the need for China to make more aggressive empty promises than it already has. The climate change mullahs are currently focused on the annual “Conference of Parties” diplo-tourism gathering that will take place this November in Scotland. After that, who knows where the children running with scissors will go.

John Kerry: a man for all seasons.

For now, companies and investors should assume that U.S. export controls targeting China will persist, but both they and especially tariffs on Chinese imports may be more fluid as the Biden-Harris administration proceeds.

In Chinese Public Company, Party Comes to You

Will China’s economic liberalization lead to political liberalization? With regrets to Bob Zoellick, we pretty much know the answer to that question. But what if its economic liberalization takes a giant leap backward? CCP boss Xi Jinping recently expanded his shakedown of uppity Chinese businessmen and corporations to education companies. Now you may never get the chance to invest in something called New Oriental Education & Technology Group, which might get your brokerage statement censored by big tech. The idea of education under anything less than total CCP control is inimical to the CCP, as is supplemental education that mostly helps rich kids leave the country. Beijing has also cracked down on other companies attempting to list on U.S. exchanges, possibly even requiring Didi, the Chinese ride-hailing company that just went public on the NYSE, to delist.

The move may actually help the USA, and not just the shareholders’ plaintiff’s attorneys who are already upgrading homes in the Hamptons at the prospect of suing their neighbors who underwrote Chinese IPOs in New York. Creative accounting at Chinese companies could pose a serious and possibly even systemic risk to U.S. markets if too many Chinese companies list. Previously, Hong Kong audits of mainland Chinese companies were merely questionable. But since Beijing has effectively nullified the rule of law in Hong Kong with the “national security” law forced on the former colony, fraud will be much easier if it serves the CCP’s expansive interests, which include protecting state-owned enterprises from competition. In going after New York-listed companies, China is trying to preserve Hong Kong and Shanghai as global financial capitals. But they are second rate and declining. Singapore, New York, Taipei, Dubai, and London should all benefit from the brain and wealth drain from Hong Kong.

RINOs Dropped from Endangered List

Fully seventeen out of fifty Senate Republicans, including Cocaine Mitch, voted for the Democrats’ infrastructure bill on Wednesday night. The usual suspects have spent months haggling with Democrats over the size of the bill, even though Democrats didn’t even pretend to hide their plan to shift any “savings” to the separate gargantuan spending (and tax) increase they plan to pass this fall on a party-line vote. The half-trillion-dollar bill is a huge waste and will do little to improve infrastructure for normal people. Instead, it spends money on bike lanes, public transportation that Americans don’t want to use, trains to nowhere, electric busses and ferries (add your own homeless and used needles), and environmental pet projects. The bill is “paid for” mostly by accounting gimmicks, but also by selling oil from the strategic reserve that we’ll have to buy back at higher prices. For every dollar spent on useful infrastructure (airports, roads, loony bins), several others will go to waste. Expect electric-infrastructure expenditures to favor blue states that wasted their money on lavish bureaucrat pensions instead of power lines.

Now With 25% More Anti-Semitism

Unilever unit Ben & Jerry’s ostentatiously declared it would not sell its ice cream in Israeli-controlled parts of the West Bank and East Jerusalem. What the Israeli-Palestinian dispute, which progressive activists are trying desperately to save from declining world interest, has to do with selling fattening goodies is unclear. Ben & Jerry’s professed that such sales are suddenly “inconsistent with our values.” That progressive preen may not be that surprising coming from the hippie-founded brand of ice cream, which in the 1980s used to proclaim “1% for peace” (a slogan that I assumed meant one percent of profits for developing higher-yield nuclear weapons and space-based missile defenses). More surprising is the revelation that Unilever, which owns Ben & Jerry’s, actually crafted the statement. The company, which owns consumer brands like Knorr, Dove, Axe, and Lipton, has found itself in hot water and is backpedaling, assuring supporters of Israel it does not support the “Boycott, Divestment, Sanctions” movement targeting Israel, even though it obviously does. Absent is an explanation of why yet another company has put its shareholders’ interests at risk to indulge radical politics unrelated to the corporation’s interests. Meanwhile, after piously criticizing competitors for shrinking the size of their ice cream packages without cutting prices, Ben & Jerry’s did exactly that. Repeatedly. Maybe they’re also kidding about this new posturing.

♫ I Want to Loot a Part of It ♫

What’s not to like about the new New York? Gritty businesses like head shops are displacing higher-end retail like Victoria’s Secret stores, which is fine since their new models imply they’ll need Costco-sized spreads in the burbs anyway. Rampant crime foretells a return to excellent vigilante movies like Death Wish or real-life vigilantes like Bernie Goetz (my go-to when a write-in candidate is needed). The young and idle are reenacting another movie, Fight Club, in Washington Square Park every few nights. (Who says youth is wasted on the young?) Informal vendors clog sidewalks, which sounds promising for those of us in the market for a knock-off Rolex. Google says the ESPN Zone in Times Square is “permanently closed.” So far, so good.

Collapsing New York also leads to campy gang movies. The Warriors (1979).

Unfortunately, for those who live and work in the city, some of these new developments are unwelcome. Many conservatives cheer the looming demise of the Big Apple, but I take the contrarian view that New York, unlike San Francisco or other decaying cities, has an ability to restore itself. Presumed next-mayor Eric Adams, a former cop, beat woke anti-police candidates who attracted mostly gentry liberals from Manhattan and fancy parts of Brooklyn. Adams dominated the rest of the outer boroughs and has vowed to restore law and order. Unlike incumbent Bill DeBlasio, he will not prioritize woke ideology, and unlike previous mayor Michael Bloomberg, his focus will not be making the city a rich man’s playground for trustafarians. Soon we all might be safe again to visit New York and have the impression Marge Simpson expressed when she first arrived: “Wow! I feel like such a nobody.”

Mediocrity of the Week

Speaking of The Simpsons, Robin DiAngelo, the wokeista who wrote White Fragility, claimed that The Simpsons, South Park, and Family Guy make people “self-consciously” racist. The word that the PhD and expert in “whiteness studies” may have been grasping for is “subconsciously.” But being wrong, race-obsessed, illiterate, and humorless never held back anyone in today’s America.