Korea’s Central Bank Outperforms Transgender Athletes (Finance Friday)

Democrats and CNN in a heap of post-Cuomo trouble, but at least profitless Robinhood was trading at 25 times revenue

The collapse of New York Governor Andrew Cuomo spells more trouble for Democrats. One reason he survived the previous round of accusations of sexual harassment was that Democrats and the progressive media wanted to keep him viable for the 2024 presidential race. More and more, President Joe Biden reflects Jimmy Carter’s presidency in 1979 and Jimmy Carter’s physique in 2021. But Democrats quietly fear that his heir presumptive, Vice President Kamala Harris, could be beaten by even a Resusci Annie if Republicans nominated one.

Fresh off of the fiasco of not managing the border crisis, the White House is inexplicably sending the giggling-handsy veep to Singapore and Vietnam to declare that “America is back.” One could hardly imagine a worse messenger. Harris learned politics at the knee of California smooth-talking power broker Willie Brown. But Harris, who dropped out of the 2020 Democrat presidential race with about one percent support, after memorably calling Biden a segregationist, has delivered some of her most embarrassing performances in front of foreign leaders. Expect a high cringe factor on the trip.

If Biden, Giggling-handsy, and Cuomo are all unlikely candidates for 2024, whom might the Democrats pick? The most viable candidate is probably Jamie Dimon, CEO of JPMorgan Chase. On Wednesday, tough cookie Maria Bartiromo grilled Dimon on Fox Business on a number of topics, including China. Dimon held his own most of the time. He said repeatedly that he was a patriot before he was head of JPMorgan (presumably he meant hierarchically, not chronologically), a refreshing sentiment from a Democrat or bigtime CEO in these woke times. You can be the judge of whether he meant it.

A candidacy by the 65-year-old Dimon, which would extend once more the ignominious hold of Baby Boomers on the presidency that began with Bubba Clinton, would figuratively (or as millennials say, literally) make Bernie Sanders’s and AOC’s heads explode. There’s no way the lefty loonies who turn up in early Democrat contests in Iowa and New Hampshire would go for a realpolitik one-percenter, so Dimon would have to gain ascendancy in later contests with huge and expensive media markets. An unlikely but not impossible revenge of the Clinton-Wall Street wing of the party?

Meanwhile the Cuomo scandal is the latest headache for increasingly pointless CNN and its joint owners, AT&T and Discovery. (AT&T thought it was flicking the CNN booger off its finger by selling partly to Discovery, but joint ownership actually means double trouble for the parent companies when CNN screws up.) Surely AT&T boss John Stankey and Discovery CEO David Zaslav don’t approve of CNN head Zucker allowing Chris Cuomo, brother of the governor, to use to CNN as a tool in the guv’s smearing of accusers? Grab your popcorn and watch the sanctimonious wokeistas reap the MeToo whirlwind.

The Crash Started by South Korea?

Progressives usually bemoan American unilateralism, but not by the Federal Reserve, especially when Fed policy is juicing an economy and ludicrous-speed government spending during a Democrat presidency. Largely unreported is that the debate of how long to wait before tightening monetary policy is occurring in a vacuum. Seemingly nowhere in the discussion is that other major economies may raise interest rates sooner, which in turn will cause their currencies to appreciate against the dollar, further driving inflation in the USA. A weak dollar almost always means higher oil prices.

Enter South Korea. While nowhere near as big of a kahuna as the euro, yen, or pound, the won and the wealthy economy it represents are nonetheless significant. According to Bloomberg, bond traders are pricing in three rate hikes in Korea over the next year, with the first coming as soon as August 26, but September or October being a more likely bet. “The degree of accommodative monetary policy should soon be partly adjusted considering the solid economic recovery is projected to continue while financial risks keep growing,” said one of the seven board members. That common-sense sentiment would get a Fed governor shot on sight by the modern monetary theorists in the USA. (Jerome Powell as another horrendous Trump personnel choice outlasting his administration is a topic for another day.)

What happens when Korea does this crazy thing called paying interest on debt? Japan and Switzerland would resist following suit, preferring inflation to allowing their currencies to appreciate against the dollar. But Britain and especially Germany, which calls the shots at the European Central Bank, will raise rates eventually. Unlike progressive-governed America, they do not have governments embarking on modern history’s largest and most unnecessary spending spree, which is being paid for by central bank purchases of government debt. Expect higher U.S. inflation and commodity prices. Will it also be the pin that pops the market balloon?

Boom

Speaking of bubbles, the way to spot one is not just when valuations are high, but when people have convinced themselves that the world has changed fundamentally and past rules no longer apply. Enter Oaktree Capital’s Howard Marks appearing on TV’s pump-and-dump central: “…there are negatives, but that’s not enough reason to take defensive action… A bubble is an irrational lift in the stock market. Today’s levels are not irrational, they’re ultra-high because interest rates are as low as they’ve ever been… This is not a time to be aggressive, but neither is it, in my opinion, a time to be highly cautious.” Mmkay. In Marks’s defense, it would suck to tell clients to pull their money to the sidelines when no one pays big hedge fund fees for that.

Another way to spot bubbles is to watch the really dumb money. “Dumb money” is an uncharitable but not unfair phrase for some individual investors, especially day traders, who think they have more information or insight than professionals but don’t. For every time a day trader at a coffee shop beats an institutional trading desk, a hundred others lose their shirts. Then there’s really dumb money: think about the cabbie talking up Netscape stock in 1999 or your friend with no real estate experience buying a third condo to flip in 2007 and suggesting you get in on the game. That is the time to run like the wind. Are we there yet?

We might be if you consider Robinhood, the discount broker at the heart of meme investing by amateurs stuck at home during the pandemic. After an initially lackluster IPO, the stock popped 50 percent on Wednesday bringing total appreciation since going public to about 100 percent. Even far out-of-the-money puts are pricey and E*Trade quoted a 36 percent interest rate to short the stock Wednesday afternoon. By Thursday morning, as the stock began what would become a 28 percent decline, E*Trade couldn’t even offer a short sale. Clearly the smart money expects an even sharper drop in HOOD stock sooner or later. And with good reason: Robinhood’s market cap exceeded $50 billion on Wednesday for a company that was running at an annualized $2 billion in sales at the end of Q1. Yes, the company was growing fast, but paying dearly for new cheapo customers helped it lose $1.4 billion in Q1. (I’m dating myself, but remember the days when you had to be profitable to go public?) For revenue, Robinhood relies on fees for trading options and payola “rebates” from market makers. How far can they get on that, especially when poor day traders get killed early in a downturn?

No WuFlu for You

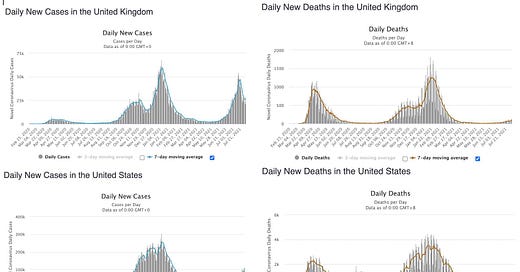

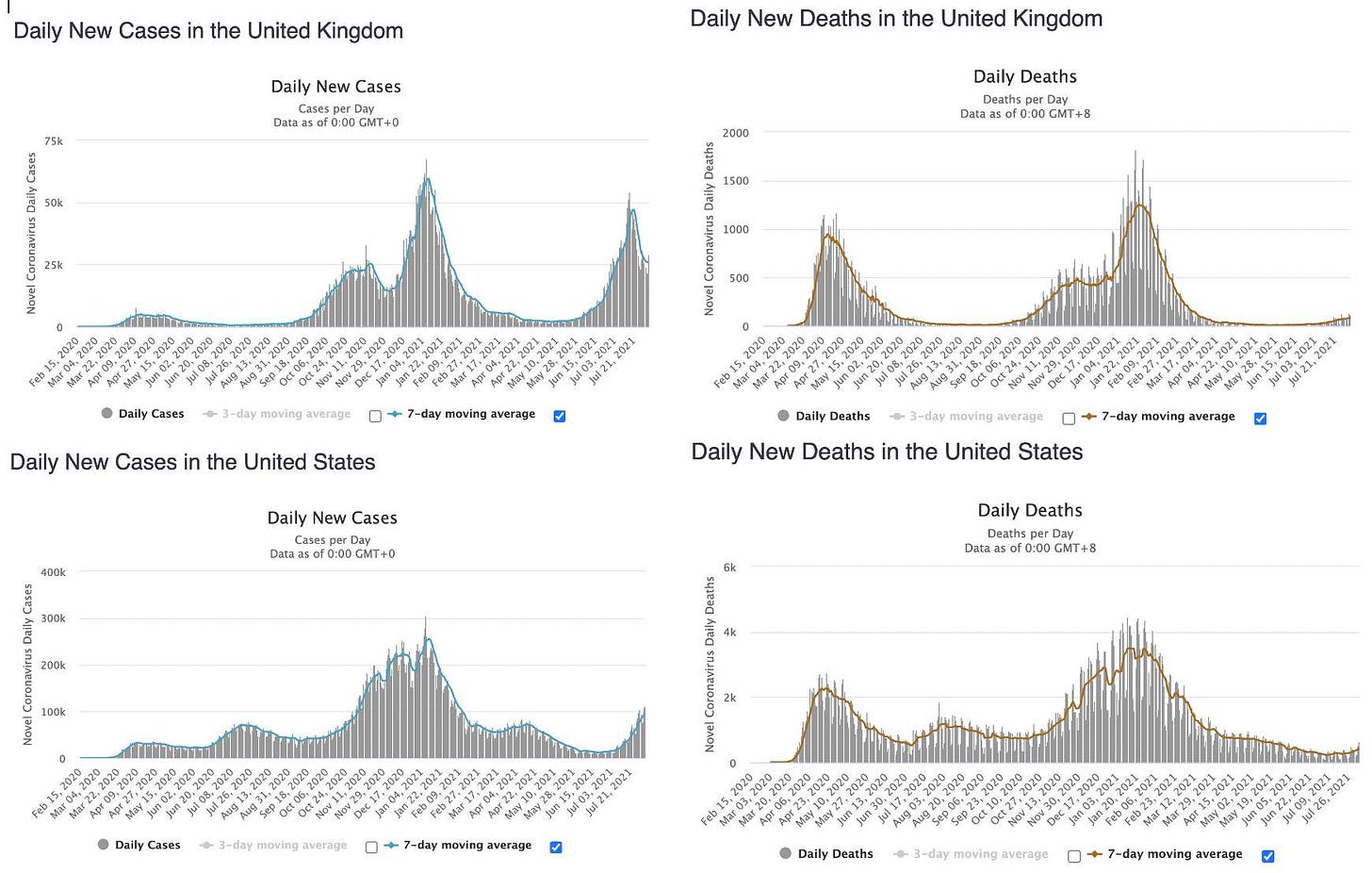

In one of his eight TV interviews per day, Anthony Fauci (kept on the job and elevated by Trump) is fantasizing about future strains of WuFlu preserving his celebrity. Busybodies from Los Angeles to Tel Aviv are telling vaccinated people to mask up again due to the spread of the Delta variant, which I gather one contracts by flying woke Delta Air Lines? (They require a picture ID to fly but think it’s racist to require one to vote.) If only there were a country that already went through a Delta wave that could help us understand the likely impact. Oh wait, there is and it even has a similar vaccination profile to the USA: Britain. As the charts below indicate, Delta does in fact cause an increase in positive Covid tests, but only produces a slight increase in deaths. In the USA, the scienticians in Washington and on TV are running wild, but the seven-day average of daily Covid deaths is just above 400. That would be five percent of the average daily deaths in the USA from all causes, which totals about 8,000 people. As Bobby McFerring coached us in 1988: “Don’t Worry, Be Happy.”

The big question is when the major economies of East Asia will reopen for business travel and then tourism. I’ve heard from more than one Asia follower that they don’t even recognize today’s Australia, which just deployed its military to enforce its latest lockdown. What happened to the can-do larrikinism that we loved so perfectly embodied by Mel Gibson and Mark Lee in 1981’s Gallipoli? Will those guys please set straight the weenies running the country today? In Northeast Asia, Japan, Taiwan, and South Korea will have to decide at some point of vaccination progress to shift from a strategy of seeking zero Covid to managed community spread—or stay closed to outsiders forever. The countries would need to accept that increasing disease is okay because of vaccination and one can’t live under a rock and prosper. Can they get their politics to that point? Certainly China will. Unfortunately, as with workers who get used to not going someplace long enough (the office), these countries face the risk of being left behind as the USA, Europe, and the Middle East normalize travel this fall. There are reports that English-language capabilities in East Asian cities are already declining.

Mediocrity of the Week

Beating up on the Pentagon is almost too easy to be sporting. Almost. Despite being double vaccinated, Secretary of Defense Lloyd Austin appeared in the Philippines wearing both a face mask and a face shield that made him look like a cross between Darth Vader and a beekeeper. What better costume to wear when begging the crooks of the Philippines government for the privilege to defend the Philippines for a few more years while Manila plays footsie with China and makes demands of us?

But taking the cake this week is Joint Chiefs of Staff Chairman Mark Milley, whom we won’t say is fat, but we will say has so much gravity that lesser generals orbit around him. When he is not addressing troops who are required to meet a physical fitness standard he declines to achieve about maneuvers he would like to see or at least hear about, Milley has been known to preach critical race theory. More recently, Milley lamented fear about a “Reichstag moment” in the closing days of the Trump administration. Perhaps the general should pick up a book instead of that second cheeseburger: As Stephen Maurer pointed out, “[The Nazis] claimed that the [Reichstag] fire had been a vast plot to topple the state, and used the lie to crush their political opponents. This makes the fire precisely the wrong precedent to cite for those who have spent months screaming that the Jan. 6 riot was an ‘insurrection.’” Milley has been decried by former President Trump, the same man who appointed him (and Jerome Powell!).

Various and Sundry Items

It’s a testament to how broken federal procurement is that company-store owner Jeff Bezos can offer the government several billion dollars in discounts and be rejected without a second thought. That’s what happened when Bezos offered NASA to waive $2 billion in fees if it permitted his Blue Origin space company to become part of a lunar-lander contract the agency awarded solely to SpaceX. But perhaps a better question is why the government is spending so much to go to the moon again. After all, the place sucks and we already own it. As Arnold admonished all those years ago, “Get your ass to Mars.”

If you thought that the Senate advancing a 2,702-page “infrastructure” bill that no senator has read might open chances for graft, you would be right. One provision (Section 218 (a)) actually does spend money on a road—a welcome relief to those of us who feared all the money would end up funding community organizers and failed 1970s ideas like Amtrak. Unfortunately the road it funds is in another country, Canada. That’s right, part of the next trillion going onto the national credit card will repave nearly 200 miles of blacktop in the Yukon, presumably at the request of Alaska RINO Lisa Murkowski. Meanwhile a blast from the past: fellow Alaskan Sarah Palin, best known for getting bigger crowds than John McCain in 2008 and never preparing for a single TV interview, has said that she will run against Murkowski next year “if God wants me to.”

The Olympics isn’t all about wokeistas getting their comeuppance and NBC losing advertising revenue. But thankfully it is mostly about that. The aggrieved women of the U.S. soccer team, led by a pink-haired super-huge-mega lesbian who refuses to stand for the national anthem, won’t be coming home with gold. The gender-bender weightlifter competing as a woman from New Zealand got nothing. And Gwen Berry, who makes herself up like a rodeo clown and turns her back on the American flag to protest the country that elevated her to the top of her profession, completely flopped. Is it possible that those who focus on woke nonsense can’t actually perform at their jobs? And might this increasingly apparent mediocrity in sports also be affecting corporate, scientific, and academic performance in woke America? Let’s just say the Chinese and Russians aren’t hoping for a return to color-blind meritocracy in the USA.

Last and least, the good folks at the Babylon Bee, who are single-handedly resurrecting satire in our humorless time, have redone hippie king John Lennon’s “Imagine” to be more accurate in describing the communism it espouses. If you look closely, there’s even a new and improved Yoko. (How is it we signed a trade deal with Japan and didn’t make Tokyo take her back?)

Have a great weekend.