First Joe Biden and the expert class of Washington and Wall Street said there would be no inflation. Then they said it would be “transient.” Now it is persistent.

So too went the story with a recession. They said there wouldn’t be one. Then they said it might come in 2023. Then maybe at the end of this year, but maybe not.

In reality, we are probably in a recession right now. This is something Americans sense in their everyday lives, but which is lost on the discredited experts whose job it is to know—and the man who stands at the helm of this ship of fools.

While most people would consider a recession to occur whenever economic times are bad—like when you’re paying five or more bucks for a gallon for gas and the cost of everything is rising—economists generally declare one when there are two or more consecutive quarters of decline in GDP. In the first quarter of this year, GDP declined 1.5 percent. So all we need is another decline in GDP for the current quarter ending June 30, which the Commerce Department will report on July 28.

These developments will come as no surprise to readers of these pages. The very first edition of Super Macro in May 2021 predicted incipient inflation and the subsequent entry argued the market was due for decline. An entry last July (“Not Winning”) illustrated how the Fed would need to start tightening well before its now-forgotten timeline of 2023.

Sure enough, on Wednesday, inflation for May came in at a 8.6%, the worst reading in decades, which topped expectations of 8.3%. In reality, inflation is worse. As the Federalist reports, even some lefty economists concede that the government undercounts inflation. The market tanked after the inflation announcement but had a bounce on Wednesday when the Fed announced a three-quarters percent increase in interest rates and the promise of an identical hike next month. That bounce reflected hope that the newly aggressive Fed would control inflation relatively soon and go back to its loose money policies that propelled the stock market bubble to its highs.

Neither will happen. Even under the new Fed plan, we will end the year with a funds rate of 3.4%. If inflation is running at its current rate, that means the government still has negative real rates (i.e., 8.3%-3.4%= -4.9%)—effectively paying banks 5% to take its money instead of charging them real interest. The market tanked again Thursday as it becomes clearer that inflation will persist and recession is imminent.

Regarding that recession, on May 26, I walked through the components of GDP, arguing most pointed toward a decline in the current quarter and therefore recession. Since then, the picture has only gotten worse. The four components of GDP and their deterioration:

Consumption – This makes up more than two-thirds of the calculation and it is probably declining. This week, the Commerce Department announced that retail spending fell in May, and it revised growth in April downward. The trend points to a dismal June to round out the quarter. Consumer confidence is down and people have burned through savings and are running up credit cards.

Investment – This component includes spending by firms and new housing, both of which are skidding. Worse, when companies cut inventories, it drags down this number. That is precisely what major retailers are doing.

Government Spending – There are still plenty of federal and state-level COVID-era programs paying people not to work, but the party is coming to an end. The government will rack up $1.4 trillion in new debt this fiscal year and spend $5.9 trillion (it “only” spent $4 trillion in the last year of big spender Obama), but that is still nearly $1 trillion less in spending than last year.

Net Exports – This category, which because of our play-the-sucker, unfree “free” trade policies and resulting persistent trade deficits is always negative, was supposed to save us from a technical recession. The previous quarter was dragged down in part by the largest trade deficit in U.S. history in March. This was supposed to improve, especially since we might import less from a China shut down by the China virus. But temporary improvement here could be offset by a strong U.S. dollar which makes imports relatively cheaper. Any improvement in trade should be too small to offset other negative factors.

In short, the recession the experts said was fanciful is probably here already, set to be confirmed when the advance second-quarter GDP estimate arrives on July 28. Furthermore, there is no salvation in sight. The government cannot engage in “stimulus” spending without causing more inflation. The same is true if the Fed goes back to a weak monetary policy (lower rates, printing more dollars), which it ordinarily would be doing amid an economic slowdown like this. Out of necessity, the Fed is doing the opposite: tightening monetary policy, just not fast enough. The result will be stagflation: economic stagnation and inflation.

For Biden and other Democrats, this news, becoming more and more apparent as the midterm congressional campaign heats up, foretells disaster. One comparable midterm was in 1974 when economic contraction contributed to voters nuking Republican congressmen (seen as the ruling party because Republicans held the White House), although the Watergate scandal also contributed. Another example was 1958 when similar economic contraction under a Republican White House led to a huge strengthening of the Democrat majorities in Congress (+6 Senate seats, +49 House seats). This economic-political near certainty, which foretells doom for Democrats in November, is also reflected by the RealClearPolitics average of generic polls. It gives Republicans a 3.4% preference margin. When the poll is merely tied, Republicans usually win big.

Even some Democrats are turning on Joe Biden and his vice president, Kamala Harris. There is a way out but Democrats will never take it: following Ronald Reagan’s example of massive supply-side stimulus through tax cuts to bring the economy rapidly back to life after inflation is controlled (and GDP is tanked) by an aggressive Federal Reserve. Reagan went from popularity ratings below 40% in 1983 when his tax cuts finally ended the recession to achieving reelection the following year with a 59-41% margin and sweep of every state except for one. No such economic and political recovery is possible for dotard Joe Biden and his team of progressive, woke ideologues. Joe Biden will be remembered for inheriting a secure America with a prosperous economy and tanking both.

Market Still Overvalued

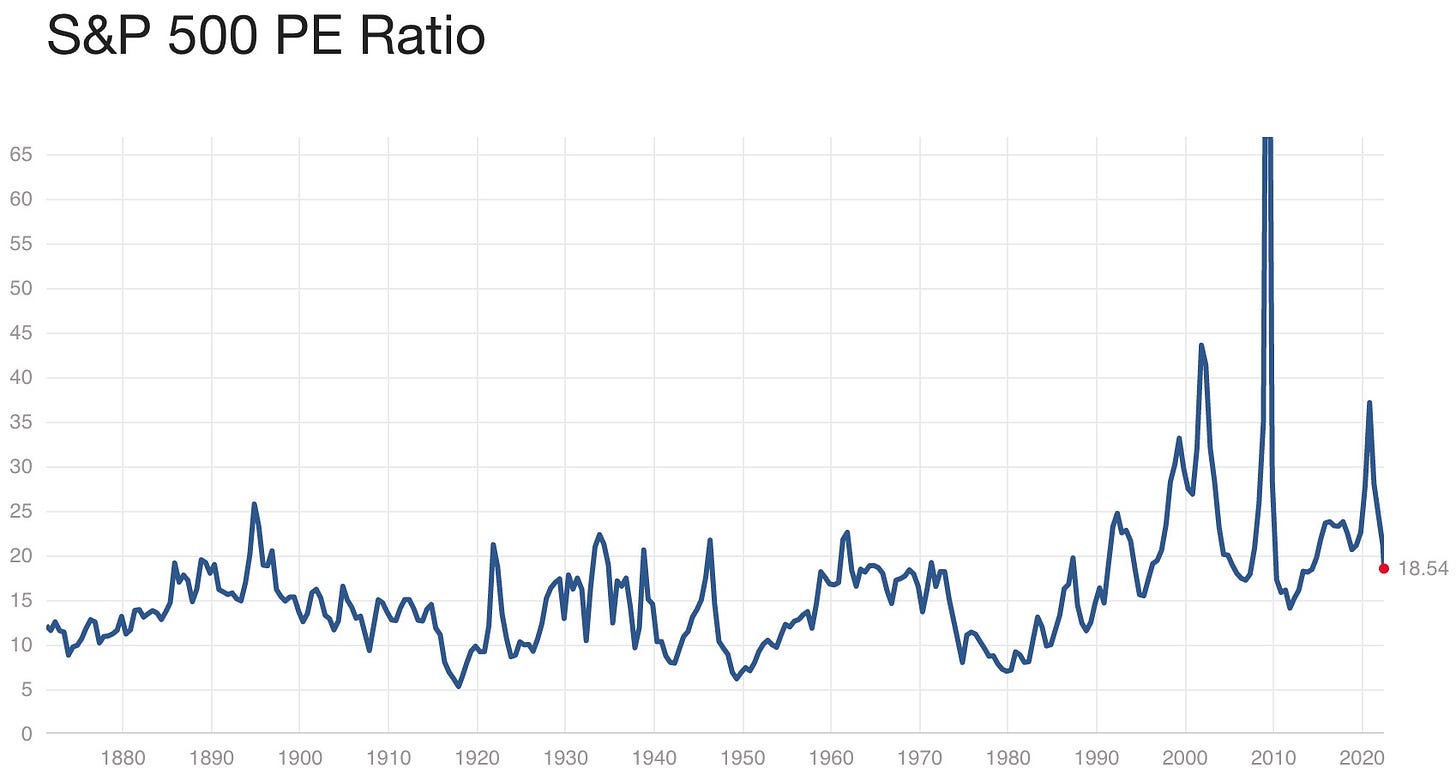

The stock and housing markets became bubbles because monetary policy was too loose for too long (basically since 2009 except for a brief period when the Fed tried to kill the Trump recovery). The Fed has created more dollars since 2018 than were created in the previous history of the Republic. Regarding the stock market bubble, the S&P 500 hit a high of 37 times earnings in 2020. Given recent market declines, the multiple is about 18.5, which is much closer to the historical average of 16, and right around the post-1983 multiple if one dates the modern U.S. economy from that point.

So, is it time to invest since equities seem to cost what they historically do? Nope. While the numerator of the price-to-earnings fraction (P/E) has declined, the denominator (i.e., corporate net income) held relatively strong through the first quarter of this year. With recession, that is about to change. Real earnings will fall, and companies always use bad times to write down assets that were overvalued even before bad times began, further dragging down net income. Thus a P/E ratio can actually increase early in a recession, which was demonstrated most clearly in 2009, when few companies were making any profit, but prices didn’t go to zero, resulting in a record-high P/E ratio. Equity prices probably won’t be cheap until we are deeper into recession, and there is big time downside risk to stock prices until then.

Biden Exxonerates Saudi Leader

Joe Biden has contacted Monica Lewinsky to borrow the presidential kneepads ahead of a trip to Saudi Arabia, where he will kiss the ring of the de facto ruler, Crown Prince Mohammed bin Salman. With his neoliberal foreign policy consisting of putting Europe first, virtue-signaling wokeness, and losing wars, Joe Biden thought it was a good idea to antagonize the Saudi leader upon taking office. The rationale for breaking with the second-largest producer of oil in the world, a big financial supporter of anti-Islamist governments in Egypt and Morocco, and one of few producers (along with the U.A.E.) possessing spare oil-production capacity, was the murder of an Islamic activist Saudi who was employed by the Washington Post to wage political warfare on the Saudi government (and non-Islamist governments in general) to the benefit of the Muslim Brotherhood. This woke policy doesn’t seem quite as awesome with oil at $120 per barrel and a gallon of regular topping five bucks.

Joe Biden will travel to Saudi in mid-July. He was going to go sooner, but the trip was delayed in order to add a stop in Israel and coincide with a meeting of the Gulf Cooperation Council and its six Arab heads of state. This way, Joe Biden can pretend to be engaging in broad multilateral diplomacy instead of just kissing the ring of bin Salman. The move comes as relative pragmatists in the administration like Brett McGurk, the supreme leader of counterterrorism or whatever, who has been in government since the Bush administration, gain temporary ascendancy over woke ideologues among the political ranks of the State Department and National Security Council. The latter groomer-friendly group wants war with any country that does not have an LGBTIQIXYZ+++ pride parade featuring transgender teenagers.

But Joe Biden will do with the trip what Joe Biden does with everything: incur all of the downside and none of the upside. McGurk and other administration officials have talked up a “50% increase” in Saudi oil production that Joe Biden supposedly secured. That is misleading. In fact, Saudi convinced OPEC+ to increase already-planned increases in output by that group for only July and August by just above 50%. Specifically, instead of planned increases of 400,000 barrels per day (bpd) each month, they will expand 648,000 bpd for those two months. The addition of this 248,000 bpd for two months to OPEC+’s overall production of 43 million bpd is a drop in the bucket, but Joe Biden’s people are trying to pass it off as significant.

This will barely make up for the slight decline in Russian exports (most of which are actually just going to new customers in India, China, and most of the rest of the world that didn’t sign up for U.S.-British tariffs on Russia). As one oil market expert observed, Joe Biden’s people hope that Saudi pledges a bigger 500,000-600,000 barrel per day increase for later in the year, or maybe even secure what George W. Bush achieved in a 2008 visit which was for Saudi to go all-in with maximum production.

The reality will be quite different: some token concessions to give Joe Biden something to show for an isolated act of elevating U.S. national interests above the woke agenda. Saudi remembers all too well how fast oil prices fell at the onset of recessions in 2008 and 2020 and doesn’t want to encourage a full repeat of those gluts.

Increasing U.S. production of oil would give U.S. consumers some relief. We are still producing 1.3 million barrels per day of oil less than peak production under Donaldus Maximus in late 2019 and early 2020. Instead of coming up with a plan to increase domestic production, Joe Biden decided to blame Exxon for not ignoring his own successful attempts to stop new exploration and production and scare away investors from domestic oil and gas.

On “Mornings with Maria” on Fox Business, I asked U.S. Rep. Ted Budd, the Republican nominee for Senate in North Carolina, why companies like Coke and Disney seem perfectly willing to play politics on matters irrelevant to their businesses, but why Exxon won’t fight back against misleading statements and policies that impact its bottom line. Budd laid the finger on woke corporate boards, and had some great comments on the sham that is ESG investing. Check out video below.

“Things are easy when you're big in Japan” – Alphaville

The G7 is failing, both on an individual country level for each of the members, and for the grouping itself, which grew out of the 1970s post-Bretton Woods economic chaos and a desire to get together rich, capitalist governments that could actually get things done. Today, it is more of a woke ComIntern where buffoons like British Prime Minister Boris Johnson talk about how to recover from coronavirus by getting the group to “build back in more feminine and gender neutral way.” Mmkay. More recently, the group has been central to foolish sanctions on Russia that have radically increased energy costs for members while affording huge discounts to the countries that still buy Russian oil (all while achieving nothing to crimp Russia’s ability to conduct war). All of these countries will decline in power and relative wealth with the possible exception of the USA if we get a good president in 2024.

The odd man out in this grouping of North American and European economies is Japan. The big question is whether Japan will follow the model of post-modern decline of the rest of the G7 or buck the trend. On one hand, Japan has a coherent, unapologetic, unwoke culture—and this confidence in itself is reflected in successive Japanese governments’ decisions over the past two decades to normalize the country’s defense and stand up to Red China. On the other hand, Japan has drunk the radical energy transition and green finance kool-aid, despite its already high energy costs. It also faces population decline and has far higher debt than any other advanced nation (more than 250% of GDP!).

A crisis may be afoot, which is concerning for those of us who root for Japan. The government is determined to keep interest rates near zero because of an economy that is contracting, but this is sparking inflation. The yen has cratered; a buck now buys you more than 130 yen. This in turn is further harming Japan’s export-dependent economy. Tourism is also in the toilet as the country has been closed for more than two years.

Is this just a hiccup or a sign that Japan’s debt-dependent economic model faces calamity? Will serious economic turmoil end the country’s political stability, especially the long tenure of the pro-American wing of the ruling Liberal Democratic Party?

In our latest episode of Simon & Whiton, Mark Simon (deputy to tycoon Jimmy Lai for 22 years) and I discuss what’s up with Japan and other topics. One of Mark’s observations:

No, the problem I’ve always said in Japan is essentially this: the Left is crazy. In other words, they’re not crazy on the woke issues and all that stuff, but they're crazy on foreign policy, on energy policy, on economic policy. So essentially we've just got this whole world of “Yes, Minister” politics.

Please check out video of the podcast or audio below, and subscribe if you like the show.

My savings is being wiped out. Democrats want me to blame Trump but I’m gonna blame every Democrat I can vote against in November.

Vote republican downnnnn the liiiiiine folks !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!