Thirty-five years ago today, China’s communist government violently suppressed peaceful protests for more freedom that had sprung up across the country. The crackdown was punctuated by a massacre in Tiananmen Square. How much longer will Chinese have to wait for a peaceful, accountable government?

The National Interest published an article I wrote today about Hong Kong turning into a dirty money hub. I enclose that article as well as a panel at the Council on Foreign Relations on Hong Kong last month, and the on-the-scene account of the Tiananmen Square protests and massacre from the late Claudia Rosett, originally published 35 years ago and republished when she died last year. Please take a look.

Why Hong Kong’s Economic Future Looks Grim

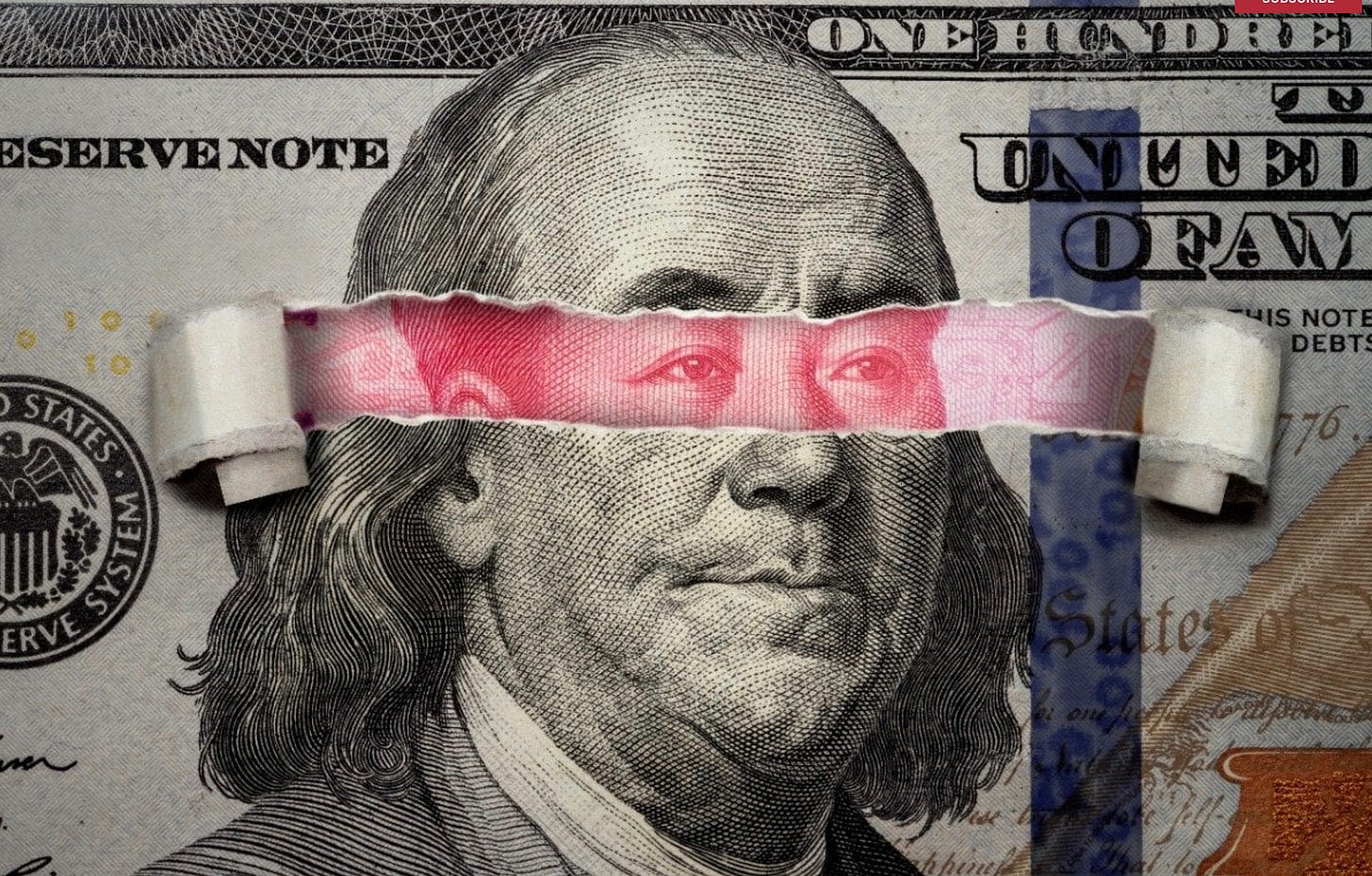

China’s takeover of Hong Kong has eroded transparency and the rule of law, opening up the city’s financial center to international money laundering and corruption.

A recent Bloomberg article reported: “Hong Kong is turning to oil-rich Saudi Arabia for new funds to help offset a growing list of challenges facing its stock market.” That is quite an understatement for what was once one of the freest, cleanest financial capitals in the world.

The reality is grimmer than the story suggests. Hong Kong may soon climb the ignominious list of finance centers that depend on laundered funds as more legitimate capital flees to locales that have not shed the rule of law.

Saudi funds are the least of the city’s problems (and an unlikely salvation for the ailing city). More suspect are funds from places like Russia or elsewhere that legitimate bankers avoid. In April, Reuters reported that Hong Kong was among the transit points for Russian firms attempting to pay Chinese companies while evading Western sanctions related to the Ukraine War. Also mentioned were legal entities in Kyrgyzstan and Kazakhstan that are friendly to Russia and convenient for Russia-related business activities—not great company.

Hong Kong’s fall from grace has been steep. The city was once a British-run capitalist outpost in China known for its professionalism and lawfulness. China’s central government promised this system would continue for at least fifty years after London ceded the colony to Beijing in 1997. Since China’s opening began in the late 1970s, Hong Kong has been a mechanism for China to access capital and for foreigners to invest in China without being impeded by the mainland’s capital controls and communist economy.

Hong Kong’s arrangement worked relatively well until Beijing promulgated a vague and sweeping national security law in 2019. The government has used the law to imprison dissidents ranging from low-level peaceful protesters to Jimmy Lai, the publisher of Hong Kong’s popular pro-democracy Apple Daily newspaper, which the government shuttered. Recently, the government and judicial system have been occupied by outlawing the singing of popular songs.

The government and businesses stuck in the city are trying to return to normalcy and portray Hong Kong as the dominant gateway to China. The Hong Kong Monetary Authority still boasts that “Hong Kong originates and intermediates two-thirds of China’s inward foreign direct investment (FDI) and outward direct investment (ODI) as well as most financial investments.” Last year, the government initiated a “Hello Hong Kong” advertising campaign stressing normalcy that even featured the chairman of the American Chamber of Commerce—a dalliance with Chinese propaganda that drew a U.S. congressional inquiry.

The reality is less hopeful. Hong Kong’s stock exchange had a paltry twelve initial public offerings in the first quarter of this year—the worst performance since the 2009 economic crisis. A Bloomberg article in March detailed a “lost generation” of financial professionals in the former boomtown and summed up the situation: “The damage is underscored by the barrage of layoffs by Wall Street firms, the retreat of global capital into the world’s second-largest economy, and the city’s diminishing role as an international financial center.”

The fall from grace occurs at a time when other banking centers have cleaned up their acts. Switzerland has largely ceased to be the haven used to hide funds from the Internal Revenue Service. A senior finance official in the United Arab Emirates plainly told me that the amount of capital in the country and region means that bankers in Abu Dhabi and Dubai simply aren’t impressed by briefcases of cash from dubious sources—the risk is not worth the reward. In February, the multilateral Financial Action Task Force dropped the UAE from its list of countries at risk of illicit money flows. Last year, Singapore arrested ten foreigners from Cyprus, Cambodia, Dominica, China, Turkey, and Vanuatu and seized $740 million in laundered funds—a reminder that the city-state intends to keep its clean image.

These developments leave Hong Kong as the path of least resistance for those seeking to deposit dirty money. The Ukraine War has accelerated the creation of new financial pathways and practices, with China and Russia, in particular, breaking from Western-dominated banks and financial data networks. This development creates opportunities not only for laundering funds from those countries but also for corrupt locales and individuals around the world.

Amid this decline, the U.S. government should recognize that Hong Kong is no longer clean or financially distinct from the rest of China and take steps to defend U.S. financial institutions from corruption. First, the U.S. Federal Reserve should revoke the Hong Kong Monetary Authority’s right to clear U.S. dollar-denominated transactions, which the Authority delegated to HSBC as its settlement institution. In 2022, several members of Congress criticized HSBC for colluding with Hong Kong authorities to harass pro-democracy activists. The Federal Reserve allows foreign dollar clearing only in Hong Kong, Japan, the Philippines, and Singapore. This mechanism, extended in 2000 primarily due to time-zone differences, allows Hong Kong banks to avoid the step of working through a U.S. bank when conducting dollar transactions.

Washington should end this privilege. It should also apply enhanced scrutiny to U.S. banks’ business in Hong Kong and encourage them to wind up operations. The Treasury should press foreign governments and institutions that want to curb money laundering to take a more jaded view of Hong Kong’s financial scene.

Should the city back off its repression and demonstrate a desire to return to the rule of law, it can restore its lost luster. Until then, the world should recognize Hong Kong as a repressive scofflaw.

Christian Whiton was a senior State Department advisor in the Bush and Trump administrations. He is the author of Smart Power: Between Diplomacy and War and a senior fellow at the Center for the National Interest.

Link to original article: https://nationalinterest.org/feature/why-hong-kong%E2%80%99s-economic-future-looks-grim-211272

Council on Foreign Relations Panel on Hong Kong

On May 23, Elliott Abrams hosted Ambassador Jim Cunningham and Caoilfhionn Gallagher at the Council on Foreign Relations for a panel titled “The Trial of Jimmy Lai and the Future of Hong Kong.” Have a look at the event page and video below.

Remembering: Claudia Rosett reported from Tiananmen

The late great Claudia Rosett was present in China as the protests grew and she was in Tiananmen Square when the PLA began its full and final assault on peaceful demonstrators. Her report, published by the Wall Street Journal, is one of the most authoritative accounts of the hopes of students and growing support from average Chinese and then the bloody crackdown. A few paragraphs of her account and a link to the rest:

Claudia Rosett at Tiananmen Square: The Communist Party Pulls the Trigger

The former Journal editor, who died Saturday, witnessed the June 1989 massacre. Here was her account.

By Claudia Rosett

May 29, 2023 2:09 pm ET

(Editor’s note: This article appeared in The Wall Street Journal on June 5, 1989. Claudia Rosett died Saturday at 67.)

Beijing

From behind a burning bus barricade Saturday night [June 3] comes the gunfire of soldiers advancing toward Tiananmen Square. The shots are answered by the angry yells of thousands of citizens defending Chang An Road about two miles west of the square. People snatch up bricks and bottles, their only weapons against the guns of their country’s own army. Then, faces grim, they start to fall back. The soldiers overrun the flaming roadblock, and under the midnight sky can be seen as a dark line of helmets moving fast toward the crowd. Panicked, people turn and run back a few hundred yards to rally by the next bus barricade. Bullets ricochet off the stone walls that line the road. A young man, blood running from his forehead, stumbles toward the sidewalk.

The crowd sets fire to a bus and a truck at this next barricade. When the truck’s gas tank explodes, a man’s pants catch fire. He runs screaming down the street, people beating at his clothes with their hands to put out the flames. Nearby, a woman climbs up on a pylon to watch the troops. Three men pull her down to safety as bullets crack into the walls just ahead. The soldiers keep coming, and behind them now shine the headlights of armored personnel carriers—their treads shaking the pavement. As the crowd falls back again, a man in thick spectacles stops a Western reporter to volunteer in English a comment that will be heard many times before dawn Sunday. “Terrible,” he says. “Very terrible.”

There is no way of knowing how many wounded and dead lie behind them; demonstrators later that night will estimate that between 40 and 70 died on Chang An Road alone, one of several routes along which thousands of soldiers are shooting their way toward the square. On Sunday, the Chinese Red Cross estimated the night’s fatalities at 2,600….

Link to rest of article: https://www.wsj.com/articles/claudia-rosett-at-tiananmen-square-the-communist-party-pulls-the-trigger-beijing-ccp-student-protest-chang-an-road-224d19be?st=2q1447d78pxw9ch&reflink=desktopwebshare_permalink

###